b&o tax seattle

You need to report the income of such sales under this classification. Seattle businesses that file their city taxes annually now have until April 30 each year to file returns and submit payments due.

City Of Seattle License Fill Online Printable Fillable Blank Pdffiller

Your business does not owe general business and occupation BO tax if you had annual income of less than 100000.

. Seattle BO tax method ruled unconstitutional March 16 2020 Contacts. 7386494 or more of payroll expense in Seattle for the past calendar year 2021 and compensation in Seattle for the current calendar year 2022 paid to at least one employee whose annual compensation is 158282 or more. You may also reach us via email recommended at taxseattlegov or by phone at 206 684-8484 from 8 am.

700 5th Avenue Suite 4250 Seattle Washington 98124-4214 City of Seattle BO Tax City of Seattle Main Tax Information City of Seattle Electronic Filing System SELF Entities engaging in business inside the Seattle city limits are required to pay a business and occupation BO tax. Sign in if you already have an account. Local business occupation BO tax rates Quarterly Annual Aberdeen 360 533-4100 0002 0003 e 00037 e 0003 e 5000 20000 Algona 253 833-2897 000045 000045 000045 000045 10000 40000 Auburn 253 876-1923 0001 0001 00015 00018 500000 Bainbridge Island 206 780-8668 0001 0001 0001 0001 150000.

The state BO tax is a gross receipts tax. You do not owe general business and occupation BO tax if your annual turnover revenues were below 100000 in Seattle. Business occupation tax classifications.

Have a Seattle business license see the due dates for that here file a business license tax return. 32 rows Business occupation tax classifications Print. For tax assistance or to request this document in an alternate format please call 1-800-647-7706.

It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax. If youre a first-time user create a business account below. Though you dont owe tax it is a requirement to file your returns and report to Seattle BO even in the case of no activity.

It is measured on the value of products gross proceeds of sale or gross income of the business. May 28 2021 By john. If you have questions regarding the Washington BO tax or other tax reform matters please contact any of the following Deloitte Tax professionals.

BO 11-7-17 Litter Tax Line 11 1. Business Occupation Taxes. But you still must file and report that to the City even if you had no activity.

Box 34214 Seattle WA 98124-4214 Public Counters Reopening Manage your account online Business Taxes Business license tax certificates Business license tax Find a licensed business Payroll expense tax. Multiply the taxable amount by the rate shown and enter the amount under. Specialized BO tax classifications.

T 1 202 521 1504 Chuck Jones Chicago T 1 312 302 8517 Lori Stolly Cincinnati T 1 513 345 4540 Patrick Skeehan Philadelphia T 1 215 814 1743. The square footage BO tax is based on rentable square feet. Nicole Bryant Seattle T 1 206 418 6042 Patrick Shine Seattle T 1 206 398 2485 Jamie C.

FileLocal offers businesses a one stop place to meet their license and tax filing needs. Teletype TTY users may use the Washington Relay service by calling 711. The City of Bellevue collects certain taxes from businesses primarily the business and occupation B O tax which includes gross receipts and square footage taxes.

Need to get a city business license or pay local business taxes like BO. City tax laws City tax rules Contact us License and tax administration 206 684-8484 taxseattlegov. Simple fast and time-saving.

206-684-8484 taxseattlegov Mailing address PO. You pay the tax if your annual taxable gross revenue is 100000 or more. If you do business in Seattle you must.

As an incorporated city one way the City of Bainbridge Island raises revenue is through its Business Occupation BO Tax levied on businesses engaging in business in the City. The Retailing BO tax rate is 0471 percent 00471 of your gross receipts. Seattle Business and Occupation Taxes.

Washington unlike many other states does not have an income tax. To 5 pm Monday-Friday excluding City holidays. Extracting Extracting for Hire00484.

In addition retail sales tax must also be collected on all sales subject to the retailing classification of the BO tax unless a specific retail sales tax deduction or exemption applies. License and Tax Administration LTA is part of the Department of Finance and Administrative Services FAS and follows FAS rule-making process. 2019 BO Model Ordinance mandatory changes to service apportionment definitions and technical changes including updated references to statutes.

Although there are exemptions every person firm association or corporation doing business in the city is subject to the BO tax. Enter the taxable sales for litter tax under Taxable Amount. PO Box 34907 Seattle WA 98124-1907 The payroll expense tax in 2022 is required of businesses with.

In addition as part of the implementation of the change a work group of city tax managers has drafted a proposed city BO apportionment model rule to assist in uniformity of implementation. The current tax rates are 039 per square foot per quarter for business floor space and 013 per square foot per quarter for other floor space Businesses whose locations are outside of Seattle are exempt and do not report or pay any square footage BO tax. Service other activities015.

Scott Schiefelbein Tax senior manager WNT Multistate Deloitte Tax LLP Portland 1 503 727 5382 Robert Wood Tax manager Deloitte Tax LLP Seattle 1 206 716 7076 References 1. Rates for Washingtons Business Occupation Tax for Master Classifications Retailing 471 percent Wholesaling 48 percent Manufacturing 48 percent Services 18 percent Some categories get special breaks some dont Manufacturingselling commercial aircraft and components 2904 percent. Learn more about the rule-making process on FAS directors rules site.

Businesses with gross revenue in the City of more than 150000 are subject to the Citys Business and Occupation Tax set at 110 of 1 0001. Our public counters on the 4th floor of the Seattle Municipal Tower 700 Fifth Ave are now open by appointment only Tuesdays and Wednesdays 830 am-4 pm. The Seattle permit to operate.

Business Tax Rules Description Browse a List of Business Tax Rules Questions about the content of any of these Rules should be directed to the Department of Finance and Administrative Services by phone at 206-684-8484 or by e-mail at taxseattlegov. Washingtons BO tax is calculated on the gross income from activities.

2021 23 Operating Budget Framework Washington State House Republicans

City Of Bellevue Business Amp Occupation Tax Return

One Thing We Learned During The Pandemic Transit S Not Dead Publicola

Events For May 1 December 1 2025 Business Impact Nw

New Washington B O Threshold Delap

City Of Bellevue Business Amp Occupation Tax Return

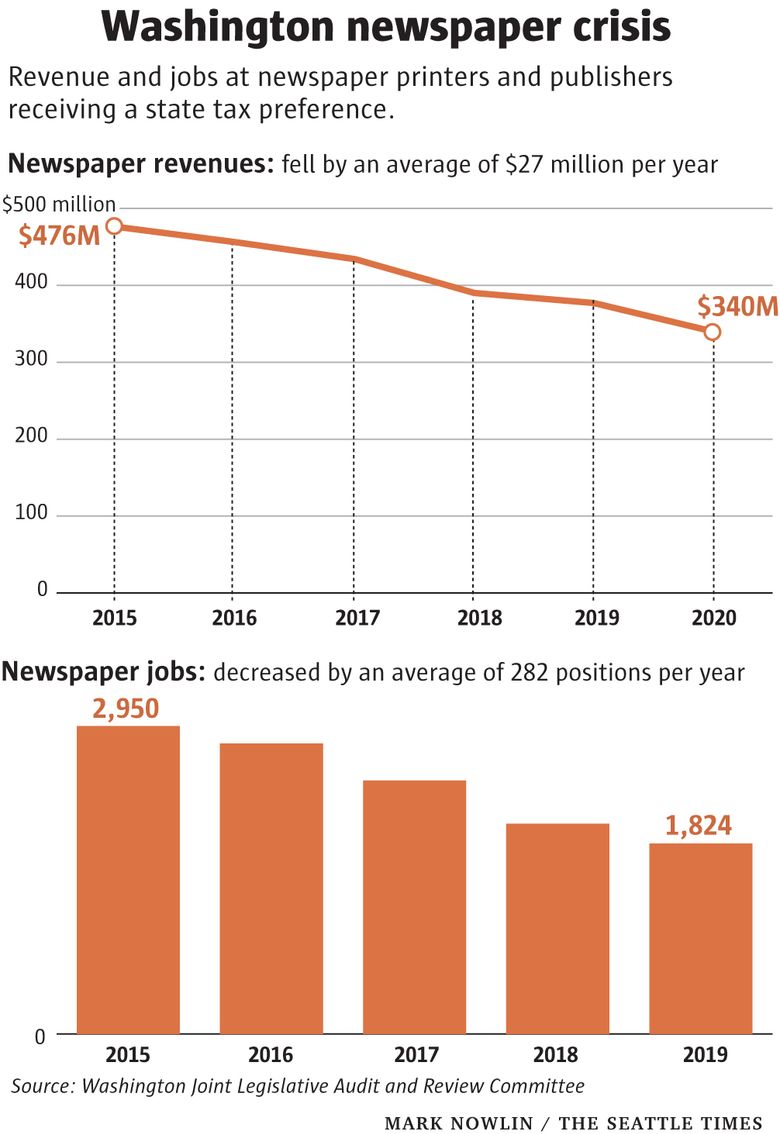

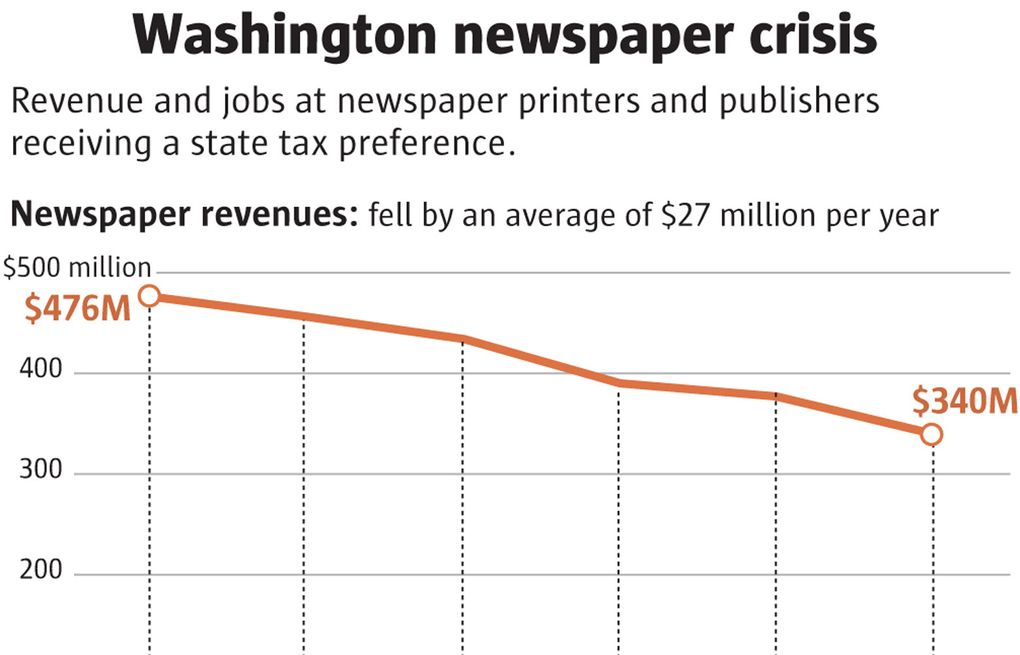

Renew State Support For Newspapers The Seattle Times

Renew State Support For Newspapers The Seattle Times

Seattle Professional Small Business Management

One Thing We Learned During The Pandemic Transit S Not Dead Publicola

Seattle Bucks The Odds Fastest Growth Rate In The Nation While Housing Affordability Drives Population From The Coasts Opportunity Washington

One Thing We Learned During The Pandemic Transit S Not Dead Publicola

2021 23 Operating Budget Framework Washington State House Republicans

Amazon Reveals Its 2019 Financials As Olympia Weighs Big Business Tax Seattle Met

Is The City Of Newcastle On An Unsustainable Financial Path We The Governed