flow through entity canada

Reserve all the benefits of an S-Corp on US earned income. In Canada however investment corporations whether mortgage trust mutual fund or partnership are regarded as flow-through entities.

7 Elements Of Cx At The Intersection Of Humans And Emergingtech Pwc Via Mikequindazzi Learn Something New Everyday Infographic Digital Transformation

Tax purposes and accordingly its operations are reported on the members individual tax return.

. Flow through entity canada. However the late filing of 2021. This post is an attempt to further.

Advantages of a Flow-Through Entity. To help clarify this issue this document also includes a practical and detailed example of a. A specified investment flow-through SIFT trust is one other than a real estate investment trust for a tax year or an excluded subsidiary entity that meets all of the following.

Flow-through shares have helped expand Canadas resource sector since their introduction to the Canadian tax system in 1954. Flow-through analysis measures the difference or. Flow-through shares FTS can provide mining companies with reduced-cost access to financing in this situation.

Corporate subsidiary Corporation form rather than flow-through form Most provinces and territories and federal corporations require initial registration as well as annual filings with. At that time the Canadian government. A single member LLC is considered a disregarded entity for US.

Looking back mining executives lawyers bankers and accountants believe this quirky. An LLC is a type of entity that is offered in the US and for US tax purposes is a flow through entity. Accounting for flow-through shares with attached share purchase warrants.

The flow-through share entered the Canadian tax code just over 25 years ago. A trust maintained primarily for the benefit of employees of a corporation or 2 or more corporations that do not deal at arms length with each other where one of the main purposes of the trust is to hold interests. A flow-through entity is a legal business entity that passes income on to the owners andor investors.

The New York State 2021-22. The entitys income only goes through a. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares of or interest in a flow-through entity the elected capital.

It is considered a separate entity for legal purposes in the US and Canada. Flow-through entities are a common device used to. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain.

Downsides to Flow-Through Entities. Though ULCs are taxed as corporations in Canada they. The basic principle behind flow-through shares which are unique to.

These entities are generally used by foreign investors to gain advantageous tax treatments in their home jurisdiction. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. It is considered a flow through entity for tax purposes.

Where a single member LLC. The Advantages of an S Corporation in Canada. Flow-through shares FTSs On July 10 2020 the Government of Canada announced changes to protect jobs and safe operations of junior mining exploration and other.

There are two major reasons why owners choose a flow-through entity. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. Again the earnings of the LLC are flowed through to the ultimate owners.

Flow-through shares FTSs For technical information concerning the FTS program you may contact the following tax services offices. A person or entity that has a place of business in Canada and that is engaged in the business of providing at least one of the following services.

Limited Liability Partnership Llp Partnership Structure Kalfa Law

How To Create A Library Management System In Excel Full Tutorial Library Management Excel

Tree Specter Christmas Tree Topper Ghost Mini Led Tree Top Etsy Canada Christmas Tree Toppers Tree Toppers Christmas Ghost

Canada Crypto Tax The Ultimate 2022 Guide Koinly

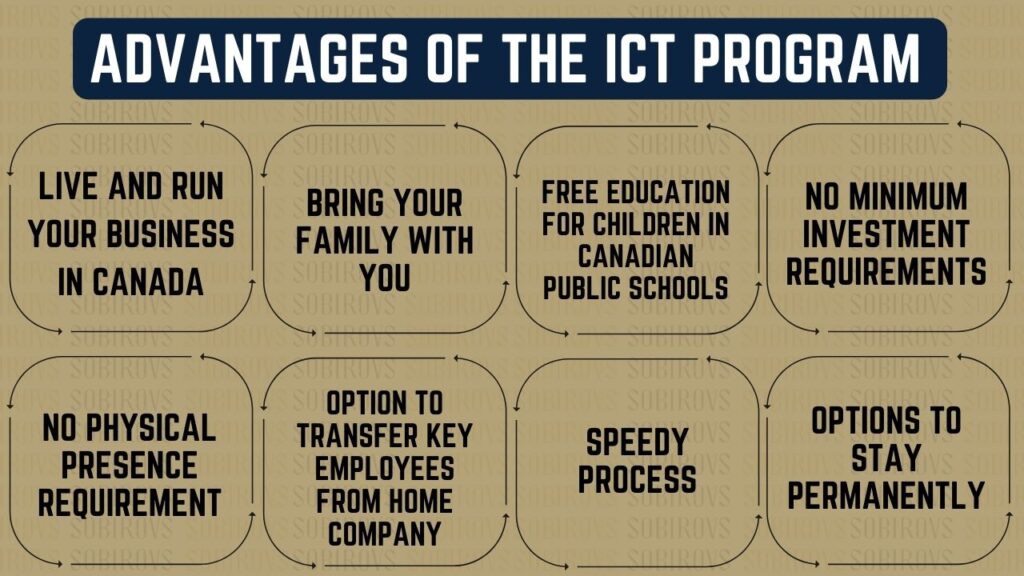

Intra Company Transfer Canada How To Expand Your Business To Canada

Temporary Overdraft How To Get Money Budgeting Finances Financial Management

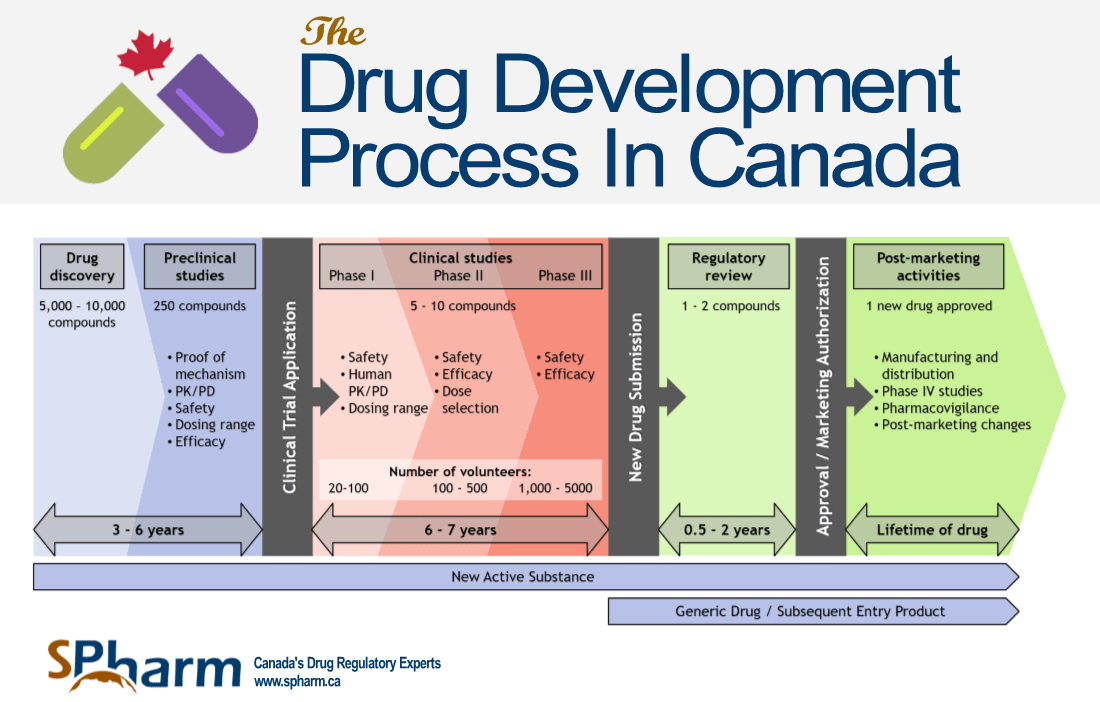

The Drug Review And Approval Process In Canada An Eguide Spharm Canada S Drug Regulatory Experts

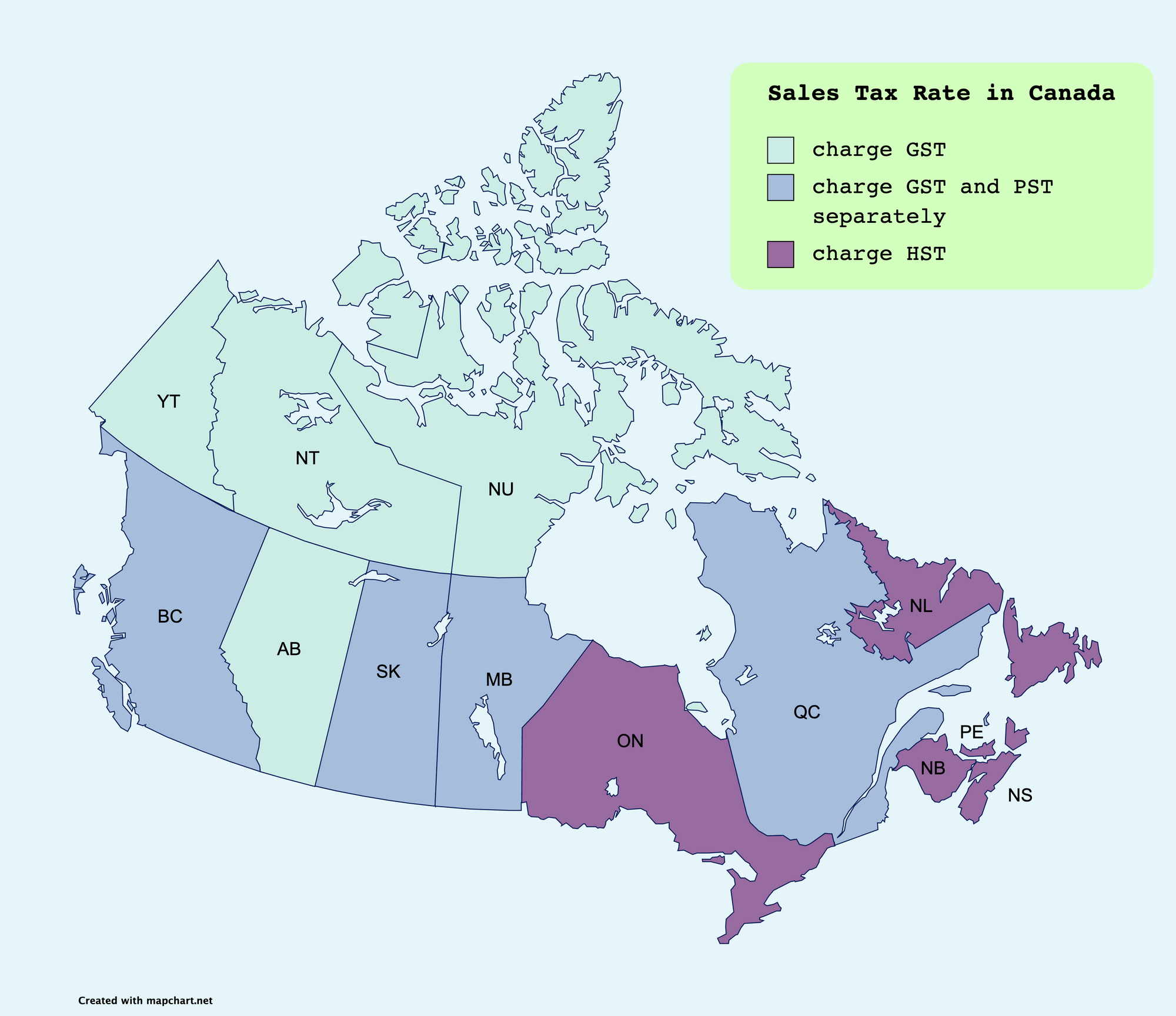

Canada Gst Pst Hst Complete Guide For Canadian Businesses

The Drug Review And Approval Process In Canada An Eguide Spharm Canada S Drug Regulatory Experts

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Master Service Agreement Template Cash Flow Statement Agreement Templates

Pin By Business School On Fdi Infographic Japan Investing

Activity Diagram For Online Shopping Website Activity Diagram Diagram Shopping Websites

Content Metamodel Enterprise Architecture Business Architecture Technology Infrastructure

6 Tumblr Newspaper Design Typography Layout Layout Design Inspiration

Some Business Analysis Techniques Critical Success Factors Use Case Diagr Business Analysis Critical Success Factors Business Development Strategy

International Tax Treaty Canada Freeman Law Jdsupra

The Drug Review And Approval Process In Canada An Eguide Spharm Canada S Drug Regulatory Experts

How Do I Make Invitations In Photoshop Techwalla Com Wedding Invitation Cards Wedding Invitation Card Design Invitation Cards