san mateo tax collector property tax

San Mateo County Property Records are real estate documents that contain information related to real property in San Mateo County California. The median property tax in Orange County California is 3404 per year for a home worth the median value of 607900.

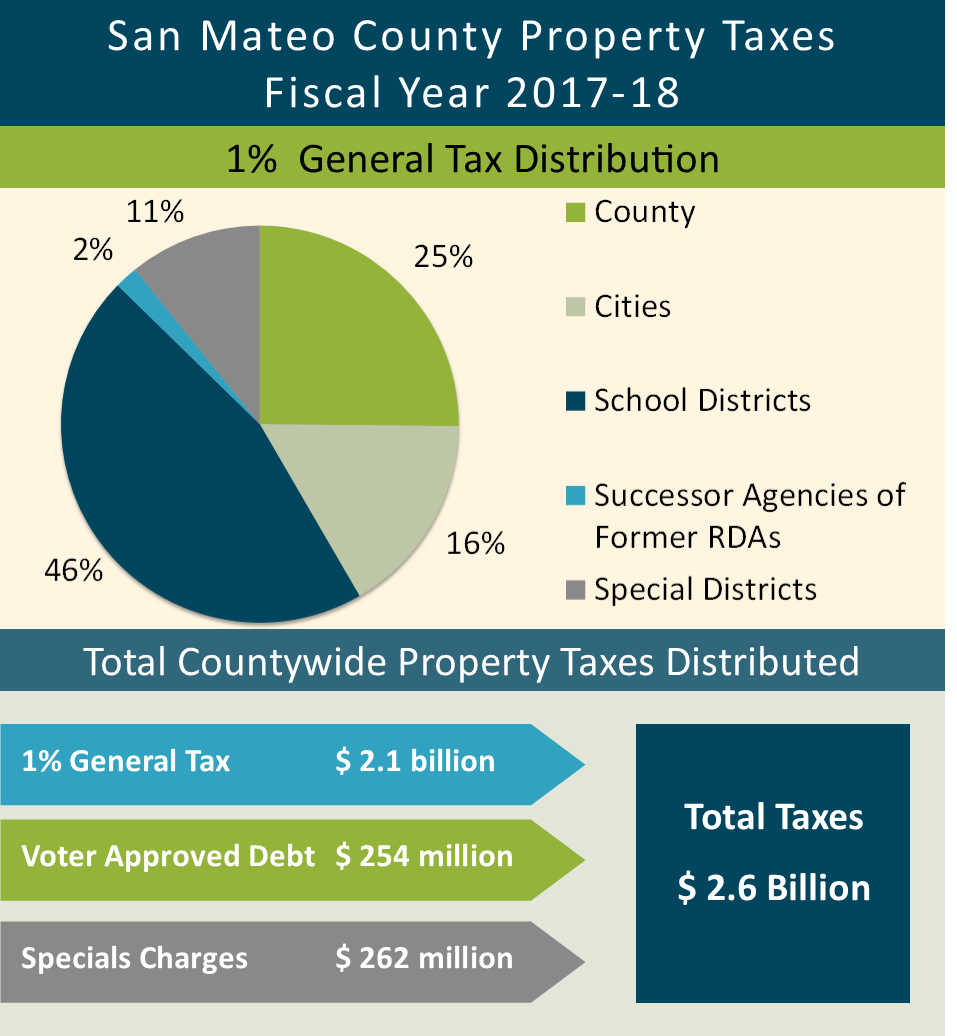

2019-06-14 Treasurer and Tax Collector Redemption Property Tax Collections Financial and Compliance Audits for Fiscal Year 2017-18.

. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts. San Mateo County Domestic Violence Council Statement Regarding the Sept. 1923 to Resume Pest Management Plan Closure of Dean Trail Archery Fire Road for Hazardous Tree Work Trail Closures in San Pedro Valley Park September 15-21.

California Propositions 60 and 90. Go to Data Online. Go to Data Online.

8 2022 Domestic Violence Homicide in San Carlos San Mateo County Veterans Commission announces Honorees for Veteran Recognition Event Ending Homelessness. Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations. Property that has become tax-defaulted after five years or three years in the case of property that is also subject to a nuisance abatement lien becomes subject to the county tax collectors power to sell in order to satisfy the defaulted.

Read reviews on over 600000 companies worldwide. The role of the Assessors Office in County Government is to discover inventory and value all real and personal property in the county. Find the one thats right for you.

City of Sacramento MappingGIS. San Francisco Treasurer Tax Collector 415 554-4400. Search all the open positions on the web.

Go to Data Online. Orange County collects on average 056 of a propertys assessed fair market value as property tax. NETR Online San Francisco San Francisco Public Records Search San Francisco Records San Francisco Property Tax California Property Search California Assessor.

This article will show you some of the most common property tax exemptions for seniors and how to determine whether youre eligible for them. 2020-01-31 Treasurer and Tax Collector Redemption Property Tax Collections Financial and Compliance Audits for Fiscal Year 2018-19. The valuations are then passed forward to the office of the Auditor Controller Treasurer Tax Collector Public Administrator which applies the correct tax rate creates property tax bills mails the bills and then collects the property taxes.

Property becomes tax-defaulted land if the property taxes remain unpaid at 1201 am. Orange County has one of the highest median property taxes in the United States and is ranked 119th of the 3143 counties in order of median property taxes. Go to Data Online.

You also may pay your taxes online by ECheck or Credit Card. County Seeks Innovative Ideas With Skin in the Game County Executive Mike Callagy Unveils a Final Budget. Products available in the Property Data Store.

The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. Get your own personalized salary estimate. Go to Data Online.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The average effective property tax rate in California is 073 compared to the national rate which sits at 107. San Francisco Recorder 415 554-5596.

Sacramento Tax Collector 916 874-6622. Bluff Trail and Other Areas Closed Sep 1928 Trail Closures in Wunderlich Park Sep. Property Tax Look-up County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

Office of the Assessor. With approximately 237000 assessments each year the Assessor Division creates the official record of taxable property local assessment roll shares it with the County Controller and Tax Collector and makes it publicly available. The average effective property tax rate in San Diego County is 073 significantly lower than the.

4 Flood Park Closed Sep. Propositions 60 and 90 are pieces of legislation that allow homeowners 55 or older to move into a new home without substantially increasing their property tax obligation. Sacramento Recorder 916 874-6334.

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

Pay Property Taxes Online County Of San Mateo Papergov

Fill Free Fillable San Mateo County Law Library Pdf Forms

San Mateo County Harbor District County Of San Mateo Ca

Sandie Arnott For Treasurer Tax Collector 2022 Pretty Proud Facebook

California Public Records Public Records California Public

Charges On Property Tax Bill Montara Water Sanitary District

San Mateo County Property Values Reach Record High For 11th Year In A Row

County Of San Mateo California Selects Taxsys Pittsburgh Pa Grant Street Group

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

Online Services San Mateo County Assessor County Clerk Recorder Elections Acre

County Controller Publishes Property Tax Highlights For Fy 2021 22 County Of San Mateo Ca

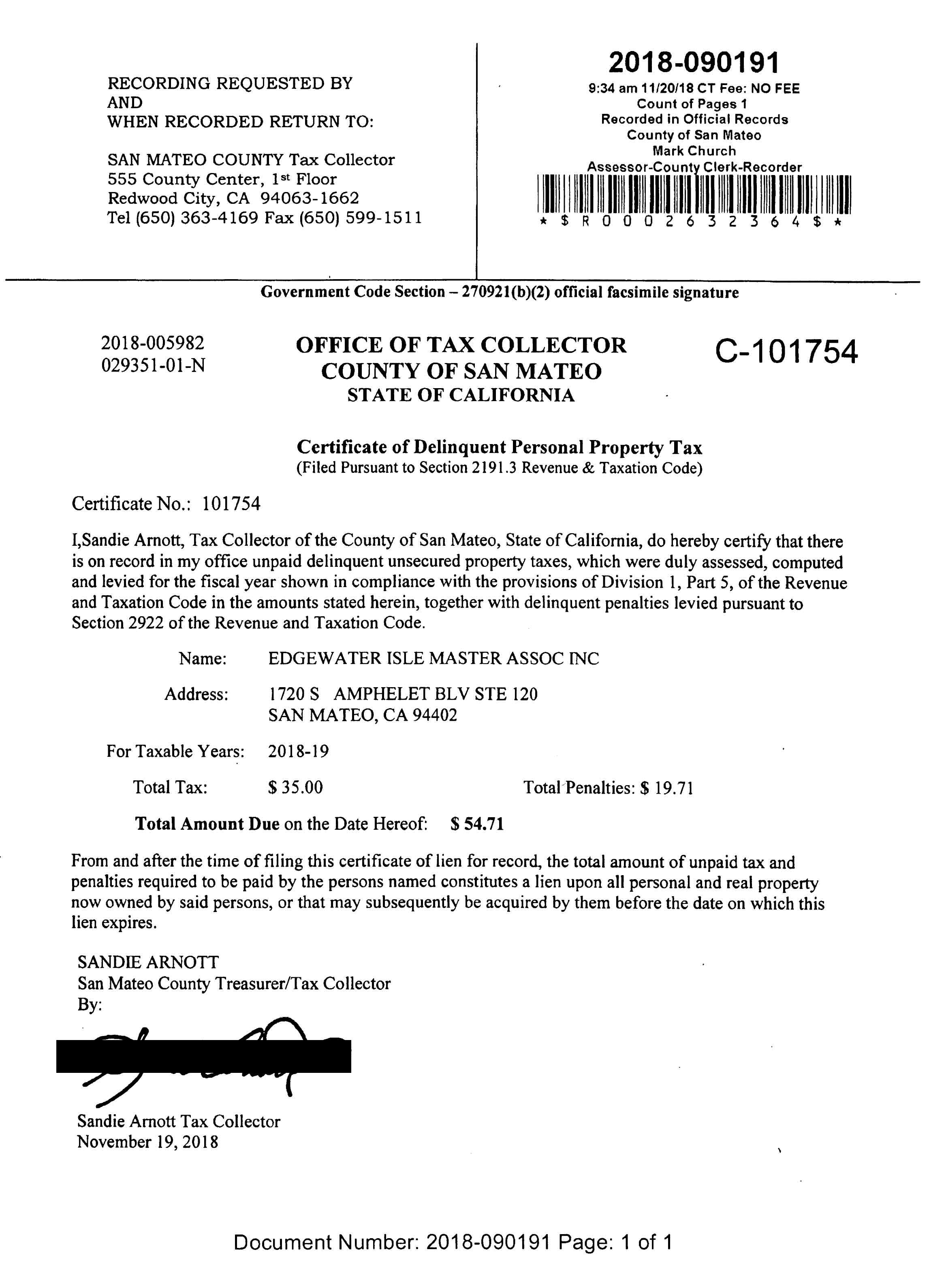

San Mateo County Issues Liens Against Master Association